Pre-Listing Board Registration Advisory

Trust Venture Partners Co., Ltd. (TVP) is very first Registration Advisor (YSX: RA 00001), approved by the YSX. Having participated in the listing support for main board listing companies in the past few years, our team has extensive experience and a diverse corporate network to provide our clients with the top-of-the-line advisory services.

What is and Why Pre-Listing Board?

Registration requirements

Compared to the Main Board, requirement for Pre-Listing Board is limited like below.

TVP supports overall process of its preparation for registration.

1 |

Public company limited by shares |

2 |

At least 100 shareholders at the time of registration date |

3 |

To adopt financial standards in accordance with financial reporting standards adopted in Myanmar and to have an audit certificate from a certified public accountant in Myanmar |

4 |

To fulfill tax duties appropriately in accordance with laws and regulations |

5 |

To impose no restrictions on the transfers of shares for registration, excluding cases where such restrictions are imposed pursuant to laws and regulations |

6 |

To subject its shares to be handled by the book-entry transfer institution |

7 |

To comply with the Securities and Exchange Law and its relevant rules (minimum corporate governance; TBD), (minimum corporate disclosure) |

8 |

To comply with AML/CFT regulation |

Process for registration on Pre Listing Board

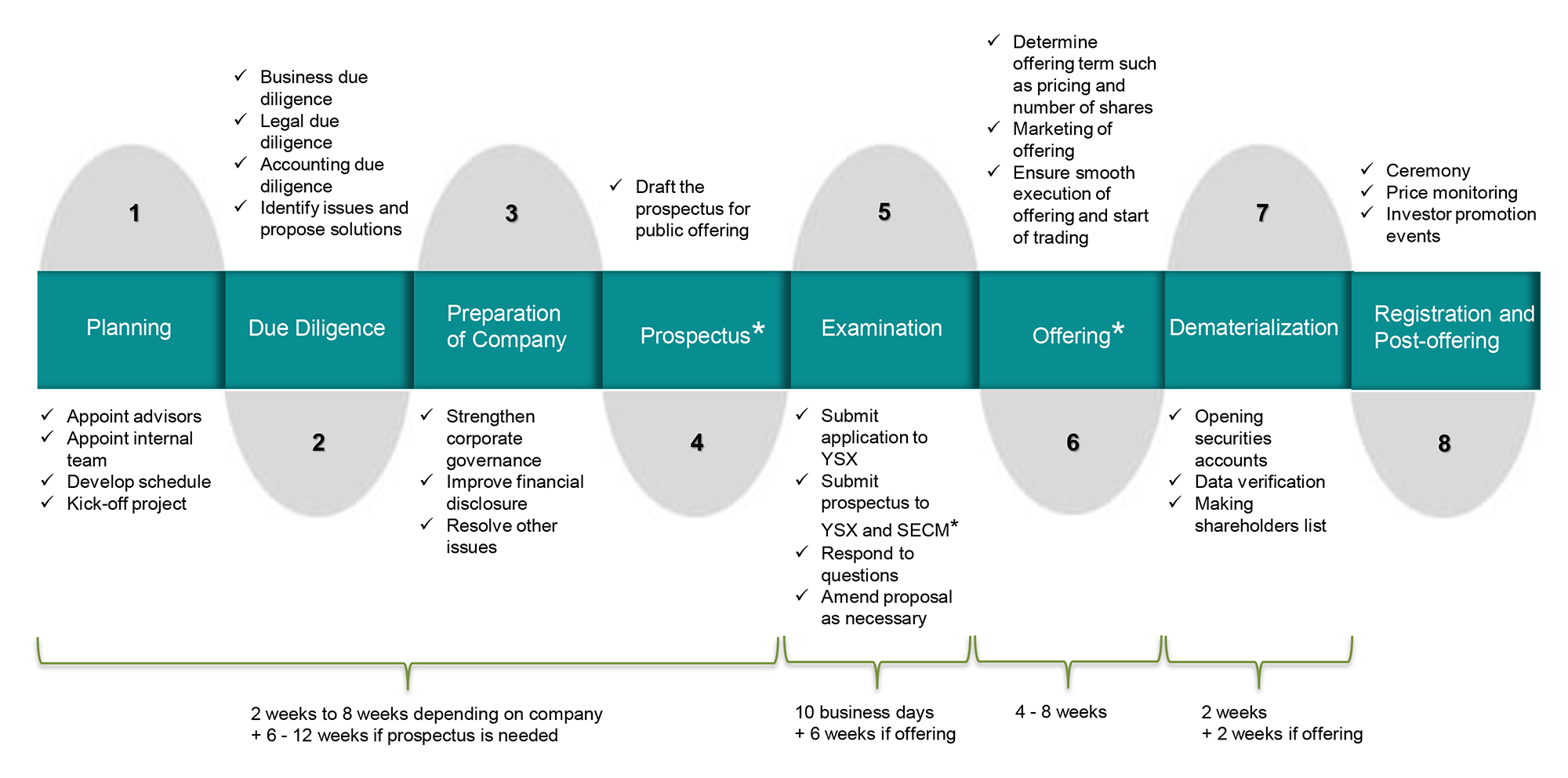

While listing on Main Board takes approximately 1-2 years for preparation, registration on Pre-Listing Board would take around 2months, though depends on status of the company’s internal management and operational status, and if public offering to be carried out at the time of registration.

Typical process for the preparation is shown below.

Our Scope of Work (Registration only)

- Familiarize ourselves with the business nature, operation, performance, position, strategy and future prospects of the client.

- Review of documents including but not limited to corporate registry documents, financial documents, business plans, material agreements between third parties.

- Conduct due diligence and provide advice in corporate housekeeping and internal improvement such as corporate governance system to build stronger corporate profile.

- Provide advice on corporate restructuring.

- Provide advice on corporate financial strategy.

- Provide advice on corporate business strategy.

- Advise the client on the relative merits, advantages and disadvantages of registration

- Prepare project timeline and develop action plan to achieve the registration within the targeted time

- Assist in corporate housekeeping and internal improvement such as corporate governance system to build stronger corporate profile.

- Assist in corporate restructuring.

- Assist in corporate financial strategy and planning.

- Assist in corporate business strategy and planning.

- Assist in forming internal project team.

- Evaluate, negotiate and recommend proposals of other consultants required for the project (if any).

- Assist in preparing registration application documents

- Liaise and respond to questions from Yangon Stock Exchange and other relevant authorities for the registration

- Perform market value assessment and consult with management on the matter

- Perform due diligence and provide recommendation letter

- Assist in dematerialization of shares and communication with shareholders, Securities companies and YSX during dematerialization process

- Provide advice and assistance on any other issue related to the registration process

- Provide aftermarket support by evaluating and giving advice on the liquidity and trading price concerns.

- Advise and assist on the post registration / offering investor relationship management such as annual reports and disclosure statements.

Our Scope of Work (Registration + Public offering)

- Familiarize ourselves with the business nature, operation, performance, position, strategy and future prospects of the client.

- Review of documents including but not limited to corporate registry documents, financial documents, business plans, material agreements between third parties.

- Conduct due diligence and provide advice in corporate housekeeping and internal improvement such as corporate governance system to build stronger corporate profile.

- Provide advice on corporate restructuring.

- Provide advice on corporate financial strategy.

- Provide advice on corporate business strategy.

- Advise the client on the relative merits, advantages and disadvantages of registration / IPO

- Prepare project timeline and develop action plan to achieve the registration and offering within the targeted time

- Assist in corporate housekeeping and internal improvement such as corporate governance system to build stronger corporate profile.

- Assist in corporate restructuring.

- Assist in corporate financial strategy and planning.

- Assist in corporate business strategy and planning.

- Assist in forming internal IPO project team.

- Evaluate, negotiate and recommend proposals of other consultants required for the project such as legal advisor and underwriter and assist in choosing the right external consultants for the IPO project.

- Review and comments on the prospectus

- Assist in preparing registration and offering application documents and documents relevant to the registration and offering process

- Liaise and respond to questions from Securities Exchange Commission of Myanmar, Yangon Stock Exchange and other relevant authority for the listing and offering process

- Coordinate both internally and externally with other consultants throughout the process for effective and efficient management of the project

- Perform Market value assessment and consult with management on the offering price

- Perform due diligence and provide recommendation letter

- Advise and negotiate underwriting discount with underwriter (if any)

- Assist in marketing, book building, allocation and delivery of shares during the offering process

- Assist in dematerialization of shares and communication with shareholders, Securities companies and YSX during dematerialization process

- Provide advice and assistance on any other issue related to the registration and offering process

- Provide aftermarket support by evaluating and giving advice on the liquidity and trading price concerns.

- Advise and assist on the post registration / offering investor relationship management such as annual reports and disclosure statements.